Banking is changing quickly. AI-powered banking conversations are becoming the norm. Customers want quick and easy ways to interact with their banks. AI-driven banking interactions are helping meet this demand. Digital assistants in banking play a crucial role in this transformation.

Why is conversational AI so important? AI-enhanced banking services enable banks to be available 24/7—eliminating the need for waiting for help. With AI-driven customer service, banks can provide answers faster. This article explains how conversational AI solutions for banking operate and why they are essential to both banks and their customers.

What you’ll learn:

- How conversational AI enhances customer service

- Key use cases of AI in banking

- The future of conversational banking

- Benefits and challenges of AI-powered banking solutions

What is Conversational AI in Banking?

Conversational AI enables customers to interact with banks as if speaking with a person. It uses AI chatbots and virtual assistants to answer questions and help with tasks. This makes banking more straightforward and quicker.

How It Works in Banking

Banks utilize AI-powered communication systems to assist their customers. These systems rely on natural language processing (NLP) to understand what customers say. Whether it’s checking balances, making transfers, or requesting a loan, AI-powered virtual assistants make these tasks easier.

Key Technologies Behind Conversational AI

The key technologies behind conversational AI in banking are NLP and machine learning (ML). NLP enables AI to understand human language. ML helps the AI learn from every interaction and improve over time. These technologies work together to make banking faster and easier.

Key Use Cases of Conversational AI in Banking

Customer Service and Support

A key application of conversational AI in financial services is enhancing customer support.. AI chat services provide fast, real-time responses. No more waiting on hold. Customers get quick answers to their questions. AI-powered banking services can also handle tasks such as resetting passwords and reporting fraud.

Automated Banking Transactions

AI-driven banking solutions also enable faster transactions. You can ask a virtual assistant to transfer money or pay a bill through banking services. The AI handles everything. It’s easier and quicker than using traditional banking apps.

Personalized Banking Assistance

AI-enhanced conversations can offer advice just for you. The system looks at your spending habits and suggests ways to save. It can even recommend products that fit your needs. This personalized help is available whenever you need it.

24/7 Availability

With AI-powered banking systems, you can get help at any time—no need to wait for office hours. AI chat services in banking are always ready to assist. Whether it’s midnight or the weekend, AI-powered virtual assistants are there to help.

Fraud Detection and Security

Conversational AI also helps protect your account. AI identifies unusual activity and can send AI-powered security alerts if something is missed. This helps stop fraud before it happens.

Benefits of Conversational AI for Banks

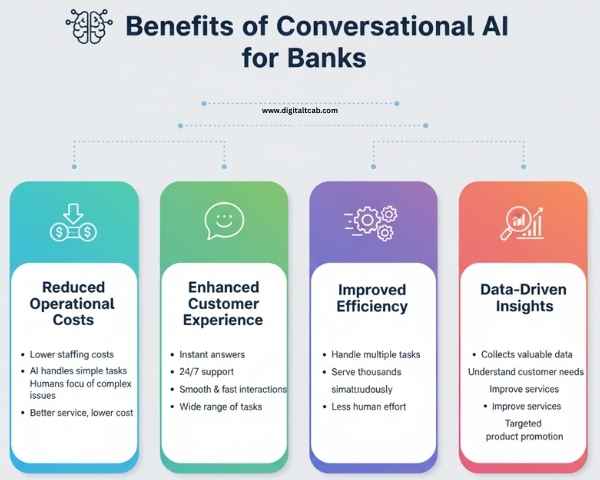

Reduced Operational Costs

Utilizing AI tools for banking services can significantly reduce the costs of banks. Instead of hiring large teams for simple tasks, AI handles those tasks. This enables human agents to concentrate on more complex issues, allowing banks to deliver better service at a lower cost.

Enhanced Customer Experience

With AI-powered virtual assistants, customers receive answers immediately. There’s no need to wait. AI chat services can assist with a wide range of tasks, from checking balances to answering questions. This makes the banking experience smoother and faster.

Improved Efficiency

AI-driven banking systems can handle multiple tasks simultaneously. Unlike humans, who can assist one customer at a time, AI chat services in banking can assist thousands simultaneously. This makes banks more efficient, enabling them to serve more customers with less effort.

Data-Driven Insights

Every time customers use AI-powered banking services, valuable data is collected. This data helps banks improve their services. For example, if many customers inquire about a particular loan, the bank can promote that product more effectively. AI helps banks better understand their customers’ needs.

AI Solutions for Conversational Banking

AI Chatbots for Banking

Many banks utilize AI chatbots for their banking operations. These chatbots handle simple tasks, such as checking balances and answering questions. IBM Watson Assistant and Google Dialogflow are platforms that help power these AI-driven banking solutions.

Voice Assistants in Banking

AI-driven voice assistants are becoming more common. You can now use voice commands to check balances or transfer money. Whether through Amazon Alexa or a banking app, these voice assistants make banking easier.

Examples of Conversational AI Tools for Banks

Platforms like Kasisto’s KAI and Clinc help banks create more intelligent AI systems. These tools offer automated banking with AI, streamlining customer interactions for faster and easier service.

Trends and Future of Conversational AI in Banking

Growing Adoption Across Financial Institutions

Increasingly, banks are adopting AI-driven banking solutions. Eighty-eight % of banking executives say conversational AI will be their primary customer service tool in the future. AI-powered virtual assistants are already enhancing the way banks interact with their customers.

Integration with Other Emerging Technologies

As AI-driven banking services improve, they are being combined with other new technologies. AI is being used with blockchain, biometrics, and IoT. AI-driven banking solutions are increasingly embedded in daily life, enhancing convenience and security in banking.

AI-Powered Banking Experience Trends

The future of conversational AI in financial services appears promising. As large language models (LLMs) like GPT-4 improve, AI banking systems will become even more powerful. These systems will handle more complex queries, offering improved customer support.

Challenges in Implementing Conversational AI in Banking

Data Privacy and Security Concerns

One of the biggest concerns for banks is protecting customer data. AI-powered banking systems must adhere to strict privacy regulations. End-to-end encryption and secure authentication help protect sensitive information.

Integration with Legacy Systems

Many banks still rely on older systems. Integrating AI-powered banking services with these older systems can be tough. However, banks need to update their technology to provide the best service possible.

Customer Trust and Adoption

Some customers are unsure about using AI chatbots and virtual assistants for banking tasks. Banks need to build trust by explaining how AI works. Transparency is key to making customers feel comfortable using AI.

Conversational AI Consultants and Experts for Banks

How Banks Can Leverage AI Consultants

Many banks turn to AI consultants for banking solutions to help with the implementation process. These experts assist banks in selecting the most suitable technology and ensuring it operates efficiently. AI consultants assist with everything from integrating systems to training staff and personnel.

Top Conversational AI Experts in Banking

Firms like Accenture, IBM, and Deloitte are experts in AI consulting for banks. These companies have years of experience and help banks use AI to improve their services. They assist with everything from developing AI tools to meeting security standards.

Frequently Asked Questions (FAQ)

1. Does FIS Have an AI System for Conversational Banking?

Yes, FIS offers AI-powered solutions for conversational banking. Their tools help automate customer interactions, making banks more efficient and cost-effective.

2. What Industries is Conversational AI Disrupting?

Conversational AI is changing many industries, not just banking. Healthcare, education, and e-commerce are all being impacted by AI-powered solutions. This technology is enhancing customer service and streamlining tasks across various sectors.

3. What Are the Key Benefits of Conversational AI in Banking?

Conversational AI enables banks to reduce costs, enhance service, and boost efficiency. By automating simple tasks, banks can better serve their customers with fewer resources.

4. How Does Conversational AI Improve Customer Service in Banks?

AI provides instant answers, handles simple tasks, and offers personalized help. This leads to quicker resolutions and better overall customer satisfaction.

5. What Are the Best Conversational AI Tools for Banks?

Some of the best tools for AI banking solutions include IBM Watson Assistant, Google Dialogflow, and Kasisto’s KAI. These systems enable banks to automate routine tasks and enhance customer interactions.

6. How Is Conversational AI Disrupting Other Industries?

Conversational AI is making a significant impact in healthcare, education, and e-commerce. It’s improving customer service and automating tasks, making everyday processes easier.

Conclusion

Conversational AI in banking is changing how we interact with financial institutions. It makes banking faster, more efficient, and provides better customer service. While there are challenges such as data security and customer trust, the benefits are clear. As AI-powered banking services continue to grow, the future of banking looks brighter than ever. Banks should embrace AI to offer faster and more personalized services.

Leave a Reply